What Does ‘Under Contract’ Mean? A Real Estate Guide

Navigating real estate transactions can be overwhelming, especially for first-time buyers and sellers. Therefore, terms like “under contract” can often lead to confusion, leaving people unsure of what to expect. To make informed decisions, we must first understand what this status means.

Whether you’re buying, selling, or investing, this guide will break down the concept of “under contract,” its legal implications, and what it means for buyers and sellers. With insights from our team of real estate law experts at Shanor & Franklin, we’ll clarify common misconceptions and provide actionable guidance for a smooth real estate transaction.

Defining ‘Under Contract’ in Real Estate Transactions

What does “under contract” mean in real estate?

When a property is, “under contract,” the buyer and seller have agreed on the terms of the sale and signed a legally binding contract. However, the deal is not yet finalized, and several crucial steps must take place before the pending sale officially closes. These steps often include home inspections, appraisals, securing financing, and satisfying contingencies outlined in the contract.

The Difference Between ‘Under Contract’ and ‘Pending’

A key distinction exists between “under contract” and “pending.” When the property status of a home is under contract, there are still conditions (such as financing approval or inspection results) that could impact the transaction. In contrast, a property labeled “pending” typically indicates that all contingencies have been met and the deal is on track for closing with minimal risk of falling through.

For buyers, a property under contract may still present an opportunity if contingencies aren’t met, leading to a potential backup offer scenario. Sellers, on the other hand, must navigate this phase carefully to ensure all conditions are satisfied and the deal progresses smoothly to closing.

From Offer to Under Contract: Key Steps in the Real Estate Process

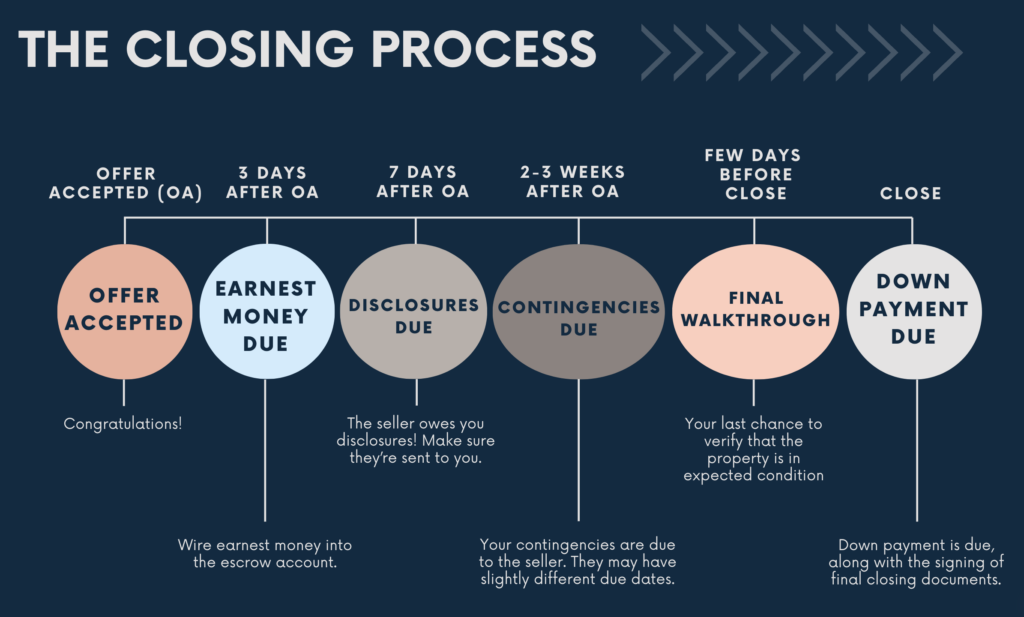

Once an offer is accepted, the property enters the “under contract” phase. This marks the beginning of a series of critical steps that must be completed before the sale is finalized.

Offer Acceptance & Contract Execution

Both parties sign a legally binding purchase agreement, outlining the price, contingencies, deadlines, and other key details. The starting point for all deadlines differs:

- Denver: Deadlines are based on the Mutual Execution of Contract (MEC) date, which is the day both parties sign.

- Dallas: Deadlines are based on the Effective Date, which is the date the last party signs and acceptance is communicated.

Earnest Money Deposit

The buyer provides a good faith deposit, typically held in escrow.

- Denver: Due within 1-3 days from MEC.

- Dallas: Due within 3 days after the Effective Date (extended if it falls on a weekend or legal holiday).

Contingencies & Key Deadlines

Most contracts include contingencies which are conditions that must be met for the sale to proceed. Common ones include:

- Home Inspection:

- Colorado: Inspection Objection Deadline (7-10 days from MEC) and Inspection Resolution Deadline (10-14 days from MEC).

- Texas: Option Period (7-10 days from the Effective Date), during which the buyer can cancel for any reason.

- Financing Approval:

- Colorado: 30-45 days from MEC

- Texas: 24-30 days from the Effective Date for final loan approval.

- Appraisal Requirements:

- Colorado: Appraisal Deadline (18-21 days from MEC).

- Texas: 7-28 days, depending on appraiser availability.

- Title Search & Insurance:

- Colorado: Record Title Deadline (10-14 days from MEC) and Record Title Objection Deadline (12-15 days from MEC).

- Texas: A title company ensures a clear title within 10-14 days depending on the property’s history.

Final Walkthrough & Closing

Before closing, the buyer ensures all agreed-upon repairs are completed.

- Closing Date:

- Colorado: Typically 30-45 days from MEC.

- Texas: Usually 30-45 days from the Effective Date.

While both Colorado and Texas have structured timelines, the main difference is how deadlines are counted. Colorado ties deadlines to the MEC date, while Texas uses the Effective Date, counting all days as calendar days. Regardless of location, adhering to these deadlines is crucial for a smooth transaction and avoiding potential contract breaches.

Legal Considerations When a Property is Under Contract

When a property is “under contract,” both the buyer and seller are legally bound to fulfill their respective obligations. Failing to meet these responsibilities without valid legal grounds can result in financial penalties, legal disputes, or even the loss of the deal.

Buyer’s Obligations

Buyers must secure financing within the contract’s timeline, complete inspections, and negotiate repairs or credits. They will also need to meet all deadlines, including earnest money deposits and contingency removals, to ensure a smooth transaction.

Seller’s Obligations

Sellers must complete agreed-upon repairs, provide required disclosures about the property’s condition, and maintain the property. This occurs right up until closing to avoid renegotiations or legal issues.

Role of a Real Estate Attorney

A real estate attorney reviews contracts for legal soundness and assists in resolving disputes. These attorneys are also here to guide clients through legal complexities to prevent costly mistakes.

That’s where we step in. Shanor & Franklin’s experienced legal team, based in Denver and Dallas, serves clients across multiple states, including:

- California

- Nevada

- Wyoming

- North Dakota

- Utah

- Montana

- Texas,

- New Mexico

- Oklahoma

- Nebraska

- Kansas

- Ohio

- West Virginia

This makes us a trusted partner across diverse regions.

Get Expert Legal Guidance for Your Real Estate Transaction

Debunking Myths: What ‘Under Contract’ Doesn’t Mean

There are several misconceptions about what it means when a property is “under contract.”

Myth: ‘Under Contract’ Means the Sale Is Final.

While an accepted offer is a big step, the sale is not guaranteed. The deal can still fall through if contingencies, such as inspections, financing, or appraisal requirements, aren’t met. Buyers may back out due to serious issues, and sellers can also face complications that delay or cancel the sale.

Myth: The Property Is Off the Market Completely.

Many assume that once a home is under contract, it’s no longer available. However, some contracts allow for backup offers. If the current buyer fails to meet their obligations, a backup offer can automatically move into place, giving another buyer a chance to purchase the home.

Myth: The Seller Cannot Accept Another Offer.

A seller cannot sign a new primary contract while under contract with a buyer, but they can accept backup offers. These backup offers remain secondary and only take effect if the original deal falls through. This allows sellers to have a fallback option without breaking their existing agreement.

Exploring Options: Making Offers on Under Contract Properties

Just because a property is under contract doesn’t mean other buyers are out of luck. If you’re interested in a home that’s already under contract, you still have options to position yourself for a potential opportunity.

Backup Offers

Submitting a backup offer allows you to step in if the current deal falls through. If the primary buyer fails to meet their obligations, your offer automatically moves into place without having to start the negotiation process from scratch. These obligations include missing financing deadlines or backing out after an inspection.

Monitoring Contingencies

As mentioned before, many contracts include contingencies that must be met before closing, such as home inspections, financing approval, or appraisals. If these conditions aren’t satisfied, the deal could collapse, giving other buyers a chance to step in. Keeping an eye on a property’s status and staying in touch with the seller’s agent can help you act quickly if the opportunity arises.

Consulting a Real Estate Attorney

Navigating backup offers and legal considerations can be tricky. Shanor & Franklin can help buyers understand their rights, draft a strong backup offer, and ensure they’re protected in case the primary deal falls apart.

Get Expert Legal Guidance for Your Real Estate Transaction

When Things Change: Understanding Contract Termination

Even after a property is under contract, circumstances can arise that lead to termination. Both buyers and sellers have specific conditions under which they can legally back out of a real estate contract, but doing so isn’t always without consequences.

Buyer’s Reasons for Termination

A buyer may terminate a purchase if financing falls through without a contingency. Termination can also occur if an inspection reveals major issues that cannot be resolved or an appraisal comes in low. All of these can prevent full loan approval unless price adjustments are made.

Seller’s Reasons for Termination

A seller may terminate a contract if the buyer breaches terms by missing deadlines or required payments. Unresolved title issues, such as liens or ownership disputes, may also prevent a clear transfer of ownership.

Consequences of Backing Out

Backing out of a real estate deal can have legal and financial consequences. From the buyer’s point of view, those without a valid contingency may forfeit their earnest money deposit. Meanwhile, sellers who unjustifiably cancel may face legal action or financial penalties.

That is why Shanor & Franklin provides expert guidance to help clients navigate these situations while minimizing risks. Our team has extensive experience in examining property titles and preparing acquisition, financing, and due diligence reports for residential, commercial, and industrial real estate. We work with fee, federal, state, and tribal lands.

Get Expert Legal Guidance for Your Real Estate Transaction

Frequently Asked Questions About ‘Under Contract’ Properties

Understanding what it means for a property to be under contract can help buyers and sellers navigate the process with confidence. Here are answers to some common questions:

What Is a Cooling-Off Period in Real Estate Contracts?

A cooling-off period allows buyers to withdraw from the contract within a specific timeframe without penalties. This period is not available in all states, so buyers should check local laws to see if they have this option.

How Long Does the ‘Under Contract’ Phase Typically Last?

The timeline varies depending on the contract terms, but it usually lasts 30-60 days. Factors such as financing approval, inspections, appraisals, and other contingencies can affect the length of this phase.

Can a Seller Accept Another Offer While Under Contract?

No, a seller cannot accept a new primary offer once under contract. However, they can accept backup offers, which remain secondary and only take effect if the original deal falls through.

What Happens if the Home Inspection Reveals Issues?

If the inspection uncovers problems, the buyer has several options:

- Request repairs from the seller.

- Negotiate a lower price to cover future repairs.

- Walk away from the deal if the issues are significant and an inspection contingency is in place.

How Does Being Under Contract Affect Property Listing Status?

Once under contract, a property’s listing status often changes to “contingent” or “pending.”

- “Contingent” means the sale is still dependent on certain conditions being met.

- “Pending” indicates that all contingencies have been satisfied and the deal is moving toward closing.

Conclusion

Understanding the term “under contract” in real estate is essential for buyers, sellers, and investors alike. It marks a crucial stage where both parties are legally committed to fulfilling the terms of the agreement, but the sale is not yet final. This phase involves multiple steps, including inspections, appraisals, financing approvals, and contingency resolutions, all of which can impact the outcome of the transaction.

Because real estate contracts carry legal and financial implications, having professional guidance can help prevent costly mistakes, missed deadlines, or unexpected complications. Whether you’re a buyer trying to secure a home, a seller looking to ensure a smooth closing, or an investor managing multiple properties, understanding your rights and obligations is key to a successful transaction.

For trusted legal counsel and representation in real estate matters, contact the experienced real estate attorneys at Shanor & Franklin today.